AbbVie’s US$100bn Deal Could Transform US Healthcare Access

Pharmaceutical manufacturer AbbVie has become the 16th major drugmaker to sign a landmark agreement with the Trump administration, committing US$100bn to domestic research and development (R&D) and manufacturing while slashing medicine costs for millions of American patients.

AbbVie has formalised a voluntary agreement with the Trump administration that could reshape healthcare access across the United States.

The North Chicago-based biopharmaceutical company joins 15 other pharmaceutical giants in a three-year accord designed to dramatically reduce medication costs for patients while strengthening America's domestic healthcare manufacturing capabilities.

The deal centres on providing substantially lower pricing within the Medicaid programme and expanding direct-to-patient offerings through the federal TrumpRx platform.

This strategic move could ensure that high-demand treatments, including Humira and Synthroid, reach millions of citizens at reduced costs.

In exchange for these pricing concessions, the government has granted AbbVie a complete exemption from pharmaceutical import tariffs and protection from future pricing mandates.

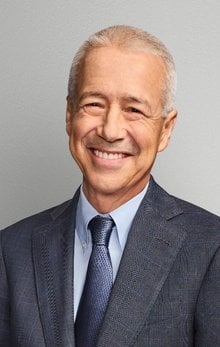

"AbbVie's mission is to make a remarkable impact for the patients we serve around the world through our innovative medicines," says Robert A. Michael, Chairman and CEO at AbbVie.

Robert says the partnership's importance in navigating a complex regulatory landscape, adding that "AbbVie is following President Trump's call to action by reaching this agreement, allowing us to collectively move beyond policies that harm American innovation".

Reshoring healthcare manufacturing capacity

At the heart of the agreement lies a substantial commitment to domestic healthcare infrastructure.

AbbVie will commit US$100bn in US R&D and capital investments, including manufacturing, over the next decade.

This capital injection could fortify the American healthcare supply chain against global volatility, addressing long-standing concerns about pharmaceutical security and patient access.

The agreement represents a critical pivot for the industry, where manufacturing stability is traded for price transparency.

Robert says: "With approximately 29,000 US-based employees and products treating 16 million Americans annually, we understand the complexity and access challenges in our healthcare system."

Industry-wide transformation for patients

The pharmaceutical landscape is experiencing a significant transformation as 16 of the 17 major manufacturers targeted by the administration have now complied with the most-favoured-nation directive.

The list includes AbbVie, Johnson & Johnson, Amgen, Boehringer Ingelheim, Bristol Myers Squibb, Roche's Genentech unit, Gilead, GSK, Merck, Novartis, Sanofi, Pfizer, AstraZeneca, EMD Serono, Eli Lilly and Novo Nordisk.

By aligning domestic costs with the lowest international benchmarks, these companies are attempting to neutralise political pressure and avoid the 100% tariffs threatened on imported branded drugs.

The administration's most-favoured-nation policy aims to eliminate "global freeloading", where foreign price controls are seen as subsidised by higher American costs.

Johnson & Johnson secured a parallel agreement with the White House in March 2025, committing to a comprehensive pricing and manufacturing strategy.

The company is executing a US$55bn US investment plan through to 2029, including the development of two new state-of-the-art facilities: a next-generation cell therapy manufacturing site in Pennsylvania and a drug product facility in North Carolina.

Johnson & Johnson CEO Joaquin Duato said in a statement the agreement shows that "when the public and private sectors work together towards shared goals, we can deliver real results for patients and the US economy".

Enhanced patient access and affordability

While the financial specifics of individual drug discounts remain confidential, the scale of the capital commitments could represent a transformative moment for American healthcare.

AbbVie's US$100bn pledge and Johnson & Johnson's US$55bn roadmap represent a significant portion of the total industry reinvestment triggered by recent executive orders.

These agreements provide a three-year grace period of stability, allowing pharmaceutical companies to plan long-term infrastructure projects without the immediate threat of pricing shocks or trade barriers.

This stability could prove crucial for patients who rely on consistent access to essential medications.

With only Regeneron remaining as a holdout among the original group of drugmakers, the pharmaceutical industry has largely accepted this new era of co-operative regulation.

Healthcare executives must now ensure that the promised manufacturing capacity is brought online rapidly to meet the requirements of the tariff exemptions and satisfy the growing demand for affordable, American-made, innovative therapies.

The agreements could herald a new chapter in American healthcare, where patient affordability and domestic manufacturing capability are prioritised alongside pharmaceutical innovation and industry sustainability.